-

Moderator

More commissions for life insurance agents

More commissions for life insurance agents

The much awaited regulation on insurance distributor commissions is finally out. So, get ready to pay more to your insurance agent from April. For life insurance, other than new commission limits, extra payments to distributors in the form of rewards have also been formalised, taking the total distributor incentive higher than what it is.

Increase in commissions

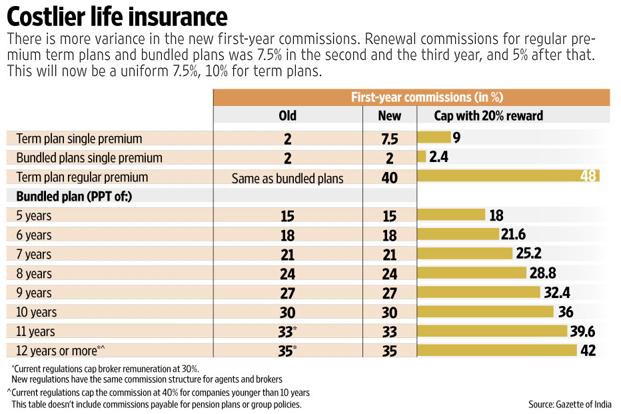

The new rules have divided life plans into two segments: pure risk products (term plans) and policies that bundle investments. The first-year commission for a regular premium term plan is capped at 40%, and renewal commission at 10% each year through the premium payment term. Commission is calculated as a percentage of the premium and is embedded in what you pay.

Commission rates until now didn’t differentiate between a pure term plan and a bundled life insurance plan. They were dependent mainly on the premium payment term and the age of the insurer. So the maximum commission of 40% was allowed if the insurer was less than 10 years old and on products with a premium payment term of 12 years or more. For older insurers, the first commission was capped at 35%.

“Insurers have already started focussing on protection plans and these regulations only nudge the industry further,” said R.M. Vishakha, managing director and chief executive officer, IndiaFirst Life Insurance Co. Ltd.

For bundled plans, the first-year commissions remain largely unchanged. Policies with a premium payment term of 5 years have a 15% upper limit whereas it is 35% for policies with a PPT? premium payment term of 12 years. The only change is that the new rules don’t allow higher commissions for younger companies. So, regardless of insurer’s age, the limit is 35%.

The big shift, however, has been the increase in renewal commissions. Till now, for agents this was up to 7.5% of premium in the second and third years, and 5% thereafter. But this will now be 7.5% every year, increasing the overall commissions. “This will encourage agents and intermediaries to service policyholders for the long term. It will also improve persistency and reduce lapsation rates,”

Source : LiveMint

|Jargon Buster|Before you post, please read the FAQ and the sticky posts on the board you wish to use.|Blog|

Tags for this Thread

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

-

Forum Rules

Reply With Quote

Reply With Quote